Table of Content

Our comprehensive database of USDA eligible listings and market info gives the accurate view of your home value. Please alert me as soon as a new USDA eligible home hits the market in the area of my choice. To browse in your areas of interest, look for properties by location. Homes with an underground pool will NOT qualify for a USDA loan.

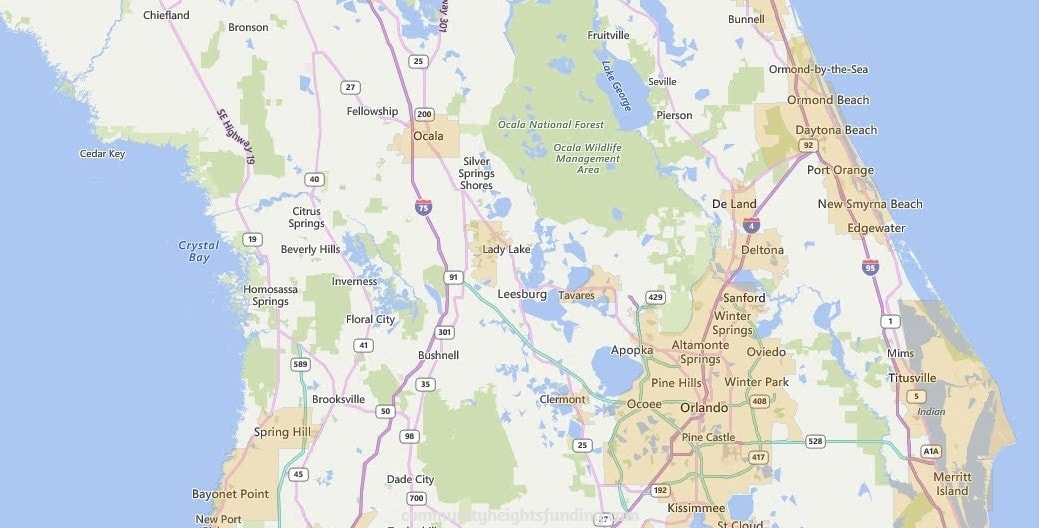

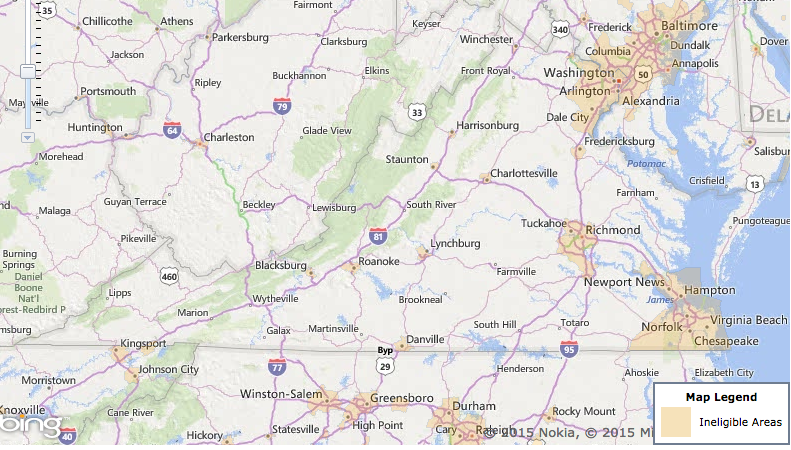

Buyers in large cities and more densely populated suburbs aren’t eligible for these loans, but many living in surrounding towns and cities may be. An area with a population of 35,000 or less can be considered “rural” in the USDA’s eyes. Perhaps you feel more at home surrounded by pastures than pavement. If so, buying a home might be well within reach, thanks to the U.S. In fact, the USDA might have one of the government’s least-known mortgage assistance programs. To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link.

FHA Home Loan Information

Each fiscal year, the Agency targets a portion of its direct and guaranteed farm ownership and operating loan funds to beginning farmers and ranchers. FSA makes direct and guaranteed farm ownership and operating loans to family-size farmers and ranchers who cannot obtain commercial credit from a bank, Farm Credit System institution, or other lender. FSA loans can be used to purchase land, livestock, equipment, feed, seed, and supplies. Loans can also be used to construct buildings or make farm improvements.

Beyond that, the USDA sweetens the deal by offering their loans with a $0 down payment from you. Direct loans come with low interest rates — three percent, as of December 2019. You can only have the option to decide between a direct or guaranteed USDA loan for single-family homes, though.

USDA Loan Property Requirements 2022

This means no investment or rental properties of any kind are allowed. If you wish to purchase a home with a USDA loan, there are property requirements that must be met in order for the home to qualify for financing. These include property eligibility based upon the location of the home, as well as certain property types, and appraisal and inspection requirements.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. Figuring out the family income, and if you meet the requirements is pretty straightforward – where most people find difficult about USDA homes, is finding a PROPERTY that qualifies for this financing! It doesn’t mean that you have to find a FARM… but it does mean that you will need to located a home that sits in a LESS densly populated area. If you already have way too many loans, your lender will perceive you as a high-risk borrower since your debt burden is already on the higher side. To increase your Home Loan eligibility, clear some loans before applying for a new one.

Farm Loans

USDA provides technical assistance and financial backing for rural businesses and cooperatives to create quality jobs in rural areas. Rural Development works with low-income individuals, State, local and Indian tribal governments, as well as private and nonprofit organizations and user-owned cooperatives. USDA works with public and nonprofit organizations to provide housing developers with loans and grants to construct and renovate rural multi-family housing complexes. Eligible organizations include local and state governments, nonprofit groups, associations, nonprofit private corporations and cooperatives, and Native American groups. In addition to a property falling within the confines of what is considered “modest housing”, a home must also meet strict “quality assurance guidelines”.

We can help you get the ball rolling on a USDA loan or any other mortgage to get you into your dream property.Contact us todayto learn more. To get a USDA loan, you’ll typically need a credit score of 640 or higher. Your lender or the USDA can help you determine if a particular property meets all of these stipulations.

There are interactive maps you can use that are directly from the USDA department in your state, and a quick Google search can help you find the one for your state. USDALoans.com is not affiliated with or endorsed by the USDA or any govt. Visitors with questions regarding our licensing may visit the Nationwide Mortgage Licensing System & Directory for more information.

This state benefit is separate and distinct from the federal VA Home Loan Guarantee and has lent nearly $9 billion in low-interest home loans to more than 336,000 veterans since 1945. To be eligible, a veteran must have served on active duty with the U.S. Armed Forces, as documented on their DD-214, and must meet one of the service criteria outlined onODVA’s website. The FMPP was created through a recent amendment of the Farmer-to-Consumer Direct Marketing Act of 1976.

All foundational, structural, mechanical, water systems, heating and cooling, as well as potential termite/pest issues must be closely inspected. Please select your state in the dropdown menu above to find your local contact for this program. There are no other additional requirements at the national level. If there are additional state-specific requirements they will be listed above.

Applications for this program are accepted through your local RD office year round. Applicants with assets higher than the asset limits may be required to use a portion of those assets. Utilizing the USDA Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas. Borrowers are required to repay all or a portion of the payment subsidy received over the life of the loan when the title to the property transfers or the borrower is no longer living in the dwelling. An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

A program sponsored by the USDA might seem to be targeted to farmers and ranchers, but your occupation has nothing to do with the qualification process. Metropolitan areas are generally excluded from USDA programs, but pockets of opportunity can exist in suburbs. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

The mortgage loan you get from the USDA can cover the cost of repairs, but it will need to be factored into the overall cost and taken out of the price of the house itself. If you’re someone who makes at or below the average salary of your area, then you could potentially qualify for a USDA loan to help you buy a house in a rural part of the United States. Keep in mind that appraisals are not as in-depth as a home inspection. Bend Park and Recreation District’s board meeting, seven applicants were selected as finalists for the vacant board positions. Due to resignations by Ariel Méndez and Jason Kropf, there are two board positions to be filled by appointment.

No comments:

Post a Comment