Table of Content

As you can see, there’s a lot that goes into determining a city’s (and a property’s) USDA eligibility. To see eligible areas in your region, simply search a local address on the USDA property eligibility map. A USDA home loan is a zero down payment mortgage for eligible rural homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture. The USDA limits the properties that you can buy based on their condition and quality.

Beyond the location, as we mentioned before, your property will have to become your primary residence. There’s no value or price limit on the house you can buy, though. Getting a USDA mortgage loan can be a tricky road to go down if you do it yourself, and that’s what we’re here for! Feel free to give us a call if you have any questions about USDA loans or how Trinity Mortgage can help you. Townhouses are also considered USDA eligible if they’re in the correct area. Because you technically gain ownership of the land beneath a townhome, you don’t have to have it approved by HUD.

USDA Home Loan Mortgage Calculator

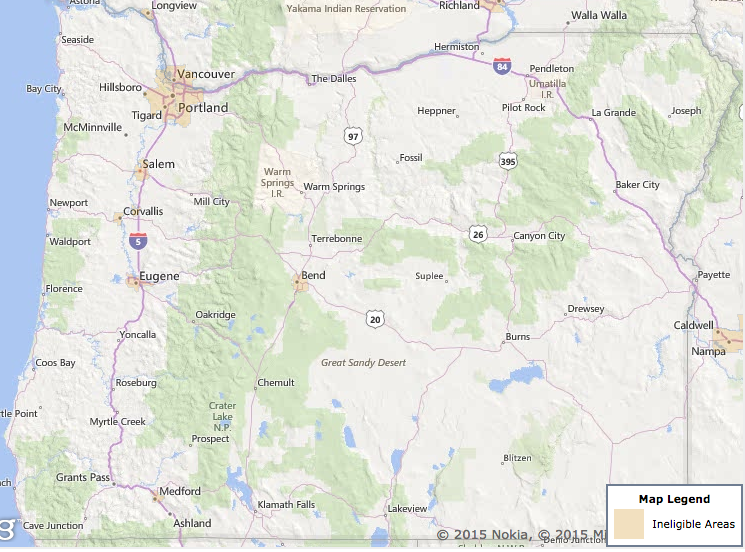

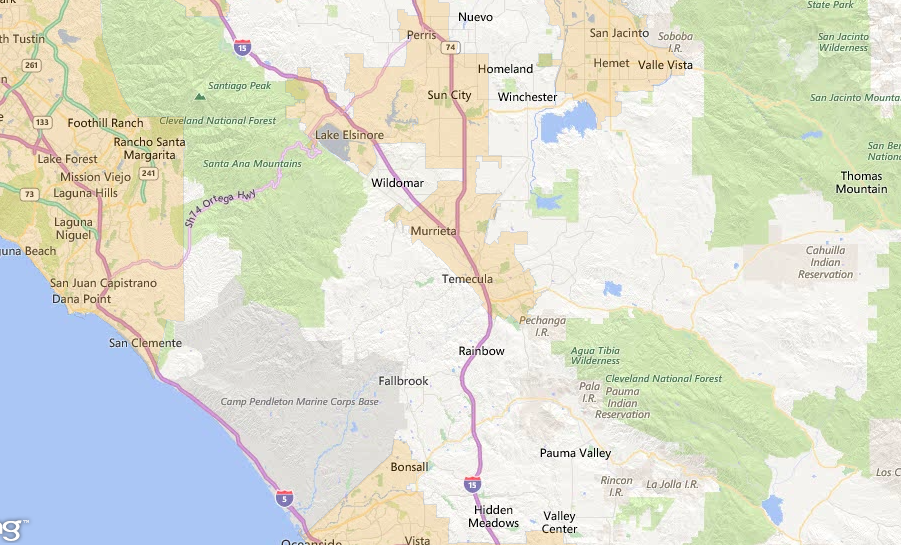

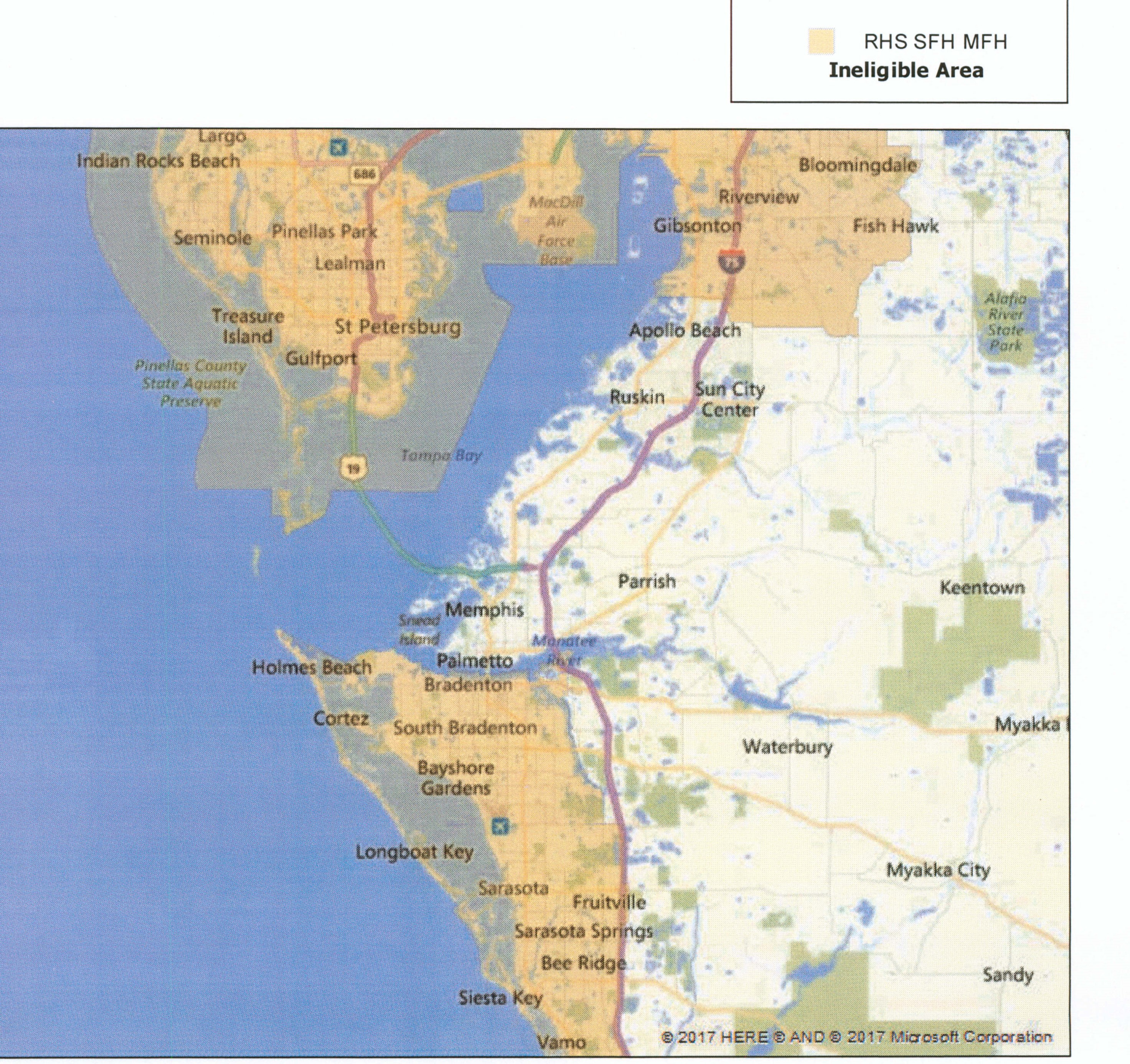

To set these rural areas, the USDA factors in a community’s population, its proximity to a major metropolitan statistical area , and overall access to mortgage credit in the area. Providing these affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. If you’re interested in a USDA direct mortgage or home improvement loan or grant, contact your state’s USDA office.

The property has to have adequate mechanical systems and be termite-free. It also has to meet the USDA's standards for being "decent, safe and sanitary." To qualify for a USDA loan, a home must have a hard or all-weather road leading to it as well. While the UDSA property eligibility map shows a general idea of qualified locations, it's best to consult a USDA lender to ensure the location is in fact eligible.

USDA Loan Property Eligibility Map

In addition, if you have an in-ground swimming pool, the appraiser will have to subtract its estimated value from your home's price. This renders a property with a pool technically ineligible for 100 percent financing, although it would still be financed for 100 percent of its value excluding the pool. USDA loans have property eligibility requirements rooted in the program's mission to boost rural communities nationwide. For a property to be eligible for a USDA loan, it must meet the basic eligibility requirements set forth by the USDA, which cover rural area designation, occupancy, and the physical condition of the home. Aspiring Home Loan borrowers are offered a loan based on whether they meet their chosen lender's eligibility criteria.

If your Home Loan eligibility is low, add a co-applicant to your application. Each program provides cost share assistance, through participating States, to organic producers and/or organic handlers. Recipients must receive initial certification or continuation of certification from a USDA accredited certifying agent . Talk to a mortgage loan officer and find the best deal on rates for your case.

Rural Development Loan and Grant Assistance

This can be used towards closing costs, as well as for “funded buy down accounts”. A funded buy down account is where the seller contributes funds to temporarily reduce monthly payments in the beginning of the loan. Another interesting fact is that the funds can be used to pay off installment debt, and even pay off a lease early.

A program sponsored by the USDA might seem to be targeted to farmers and ranchers, but your occupation has nothing to do with the qualification process. Metropolitan areas are generally excluded from USDA programs, but pockets of opportunity can exist in suburbs. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

The condition of the property you want to finance with a USDA loan must meet certain requirements. The appraisal should render sufficient evidence and validation that the property meets quality guidelines. The USDA wants to ensure that the location, size, and basic amenities meet the actual appraised value. The other side of this is that the USDA want to ensure that your home will have decent, safe, and sanitary conditions. They also have lower interest rates than many other loan programs, and their guarantee fee — the USDA’s approach to mortgage insurance — is cheaper than on other mortgages as well.

For family with 1-4 members current income limits in Orlando, FL $90,300/- whereas for a family with 5-8 members income limits go upto $119,200/-. Learn more about FHA home loans below, including the requirements to get an FHA loan, the 2022 FHA loan limits, and an FHA mortgage calculator. The USDA outlines specific minimum property requirements (MPR’s) to ensure the house you buy is a safe and sound investment.

Keep in mind that you’ll only be approved for up to 30% of your income to use on a mortgage payment. USDA loans cannot be used for investment properties, meaning farms, rental or vacation homes, and other income-producing properties aren't eligible. However, a property with acreage, barns, silos and so forth that are no longer in commercial use may still qualify. Property eligibility areas can change annually and are based on population size and other factors.

A USDA loan is a great option for most people because it doesn’t ask for any money from you, so it covers 100% of the mortgage. However, this can cause some issues if the seller is asking for more than the property is worth. USDA eligible properties have to be part of a rural area, so things like population size and even city limits matter. You have to find a home that’s also eligible for a USDA loan, and determining USDA property eligibility is a bit more involved. To verify your address for a USDA loan, it is best to speak with a USDA-approved lender. A USDA-approved lender can verify all properties you are interested in and ensure you don't waste valuable time on properties that may not be eligible.

No comments:

Post a Comment