Table of Content

The median price of a single family home in Orlando, FL is $588,130/- having a covered area of 2,124sqft. On an average it costs about 276/sqft of living space which is 9% cheaper than the state average of 303/sqft. Homes in Orlando, FL are about 34% cheaper than other areas in the state. USDA loans allow for more acres than conventional and FHA loans . There is not an exact number of maximum acres that are allowed, but the land can not exceed more than 30% of the appraised value of the property. If your credit falls below 640 or you’ve not established credit history, you may find you can still get a USDA home loan by talking with a knowledgeable USDA lender.

A USDA loan is a great option for most people because it doesn’t ask for any money from you, so it covers 100% of the mortgage. However, this can cause some issues if the seller is asking for more than the property is worth. USDA eligible properties have to be part of a rural area, so things like population size and even city limits matter. You have to find a home that’s also eligible for a USDA loan, and determining USDA property eligibility is a bit more involved. To verify your address for a USDA loan, it is best to speak with a USDA-approved lender. A USDA-approved lender can verify all properties you are interested in and ensure you don't waste valuable time on properties that may not be eligible.

USDA Home Loan Information

This number compares your monthly income to your monthly debt payments. Keep this number under 45 percent for your best chance of qualifying. The content on this site is not intended to provide legal, financial or real estate advice.

USDA provides technical assistance and financial backing for rural businesses and cooperatives to create quality jobs in rural areas. Rural Development works with low-income individuals, State, local and Indian tribal governments, as well as private and nonprofit organizations and user-owned cooperatives. USDA works with public and nonprofit organizations to provide housing developers with loans and grants to construct and renovate rural multi-family housing complexes. Eligible organizations include local and state governments, nonprofit groups, associations, nonprofit private corporations and cooperatives, and Native American groups. In addition to a property falling within the confines of what is considered “modest housing”, a home must also meet strict “quality assurance guidelines”.

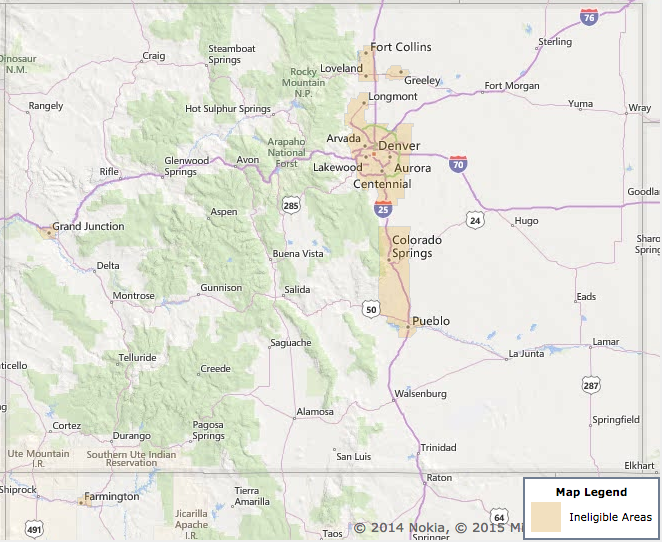

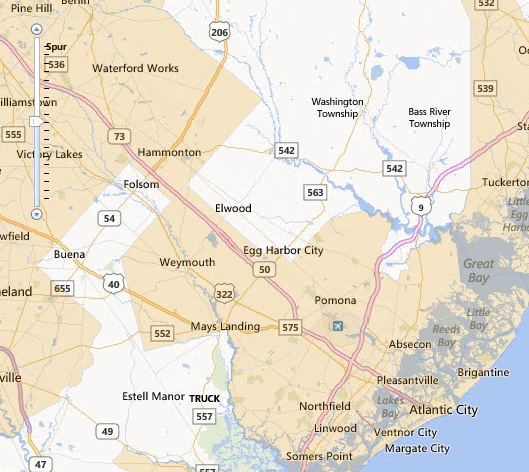

Property Eligibility

Homes must be located in an eligible rural area to qualify for a USDA loan. According to the Housing Assistance Council, 97% of U.S. land qualifies as “rural” in the USDA’s eyes, accounting for about 109 million people. Additionally, the property must serve as your primary residence. Additionally, your lender may ask you to establish what’s called a non-traditional tradeline. This is done showing 12 months of on-time payments on utility bills, rent, health insurance premiums, or other regular expenses. Showing your willingness and ability to maintain these monthly obligations strengthens your loan application for underwriting.

Repairs of an Existing Property – Any pertinent repairs must be completed prior to the closing and funding of the loan. This includes anything deemed to be essential to having a “decent, safe, and sanitary” home. Any critical repairs or necessary replacements will be outlined by the appraiser.

Home Loan Eligibility Calculator

This number plus one percent and rounded up by .25 percent on the day you lock in your loan will be the interest rate. To obtain a direct USDA loan, you have to show that you can’t get a loan from another lender. You also will have to show that you don’t have access to any other housing that’s safe, clean or otherwise fit for life.

The property has to have adequate mechanical systems and be termite-free. It also has to meet the USDA's standards for being "decent, safe and sanitary." To qualify for a USDA loan, a home must have a hard or all-weather road leading to it as well. While the UDSA property eligibility map shows a general idea of qualified locations, it's best to consult a USDA lender to ensure the location is in fact eligible.

This is due to changes to what the USDA considers eligible as laws and populations change. You can use this interactive map to help determine if a home currently meets the USDA's property eligibility requirements. Areas in red are not currently eligible for a USDA-backed loan. The Oregon Veteran Home Loan Program offers eligible veterans fixed-rate financing for owner-occupied, single-family residences in Oregon. The veteran home loan product is a non-expiring, lifetime benefit for any eligible Oregon veteran and may be used up to four times.

The amount you can earn to have access to USDA loans is limited and varies by location and household size, so use this tool for more specific guidance. Payment assistance is a type of subsidy that reduces the mortgage payment for a short time. The amount of assistance is determined by the adjusted family income. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance.

USDA loans provide an affordable financing option for low-to-moderate-income homebuyers. Because of this, your household’s total income can’t exceed local USDA income limits. Income limits are calculated using 115% of the area’s median household income. The USDA usually issues direct loans for homes of 2,000 square feet or less, with a market value below the area loan limit. Home loans can be as high as $500,000 or more in pricey real estate markets like California and Hawaii, and as low as just over $100,000 in parts of rural America. USDA, through the Farm Service Agency, provides direct and guaranteed loans to beginning farmers and ranchers who are unable to obtain financing from commercial credit sources.

Beyond that, the USDA sweetens the deal by offering their loans with a $0 down payment from you. Direct loans come with low interest rates — three percent, as of December 2019. You can only have the option to decide between a direct or guaranteed USDA loan for single-family homes, though.

USDALoans.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC (NMLS #1907), that provides mortgage information and connects homebuyers with lenders. Neither USDALoans.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with the U.S Department of Agriculture or any other government agency.

No comments:

Post a Comment